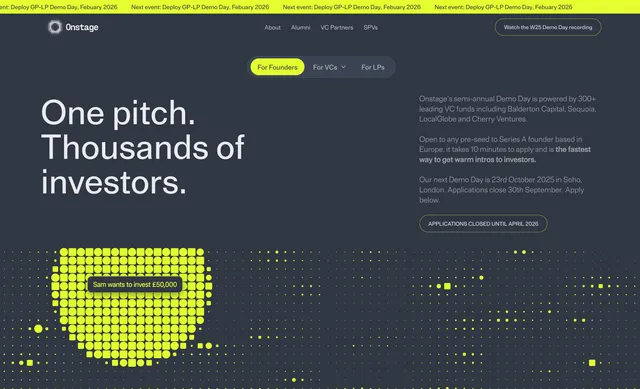

Onstage W25 demo day: 21 startups pitch to 200+ investors

Twenty-one founders stood before a room packed with over 200 investors on October 23, 2025. These startups represented the top 1% of 1,500 applications to Onstage's W25 Demo Day.

Twenty-one founders stood before a room packed with over 200 investors on October 23, 2025. These startups represented the top 1% of 1,500 applications to Onstage's W25 Demo Day.

About Onstage and the W25 Demo Day

Onstage runs one of Europe's most selective demo days, connecting early-stage startups with a network of 300+ venture capital firms, including Balderton Capital, Sequoia, LocalGlobe, and Cherry Ventures. Now in its fifth year, the platform has helped founders raise over £480 million from top-tier funds.

This year's W25 Demo Day marked a milestone: Onstage's first fully in-person event. After years of virtual pitches, founders and investors gathered at a London theatre for what has become a fixture in the European startup calendar.

The companies presenting ranged from pre-seed to Series A, spanning legal tech, gaming, healthcare, and consumer services. What they share: each is building solutions to specific problems rather than chasing broad platform plays.

The finalists

Narrative AI - Agentic operating system for law firm profitability

Time tracking, billing, matter management, resource allocation—law firms spend countless hours on tasks that don't directly generate revenue. Narrative AI built an operating system designed specifically for law firm profitability, using AI agents to automate administrative workflows while giving partners real-time insights into which matters and clients drive the highest returns.

Falkin - Embedded AI scam prevention

Scammers exploit mobile channels that traditional fraud tools can't monitor effectively. Falkin embeds scam detection directly into digital banking apps, analysing suspicious links, messages, and phone numbers in real-time—before users transfer money. The shift is from reactive fraud prevention to proactive protection when users are most vulnerable.

Smart Bricks - Agentic AI platform for real estate investment

Finding profitable real estate deals means sorting through thousands of listings, analysing market data, and evaluating risk factors manually. Smart Bricks built an AI platform that automates these tasks—discovering properties, evaluating investment potential, and providing detailed analysis. The system brings institutional-grade capabilities to individual investors and family offices. Backed by 500 Global and Techstars, the company has raised between £500,000 and £1 million.

Unison (Hyper Unison Ltd.) - AI data infrastructure for multi-omics in clinical trials

Clinical trials integrate data from genomics, proteomics, patient records, and biobanks. This data rarely arrives in compatible formats, forcing research teams to spend months harmonising information before analysis begins. Unison built an API that automates this process, using machine learning to map data from different sources into a common format. What used to take months now takes minutes. Episode 1, Passion Capital, and Octopus FCF backed the company's £1-2 million raise.

LangWatch - Platform for testing, evaluating, and simulating AI agents

How do you test systems whose behaviour is probabilistic rather than deterministic? That's the challenge companies face when building AI agents. LangWatch provides a platform for testing AI agents before deployment—simulating user interactions, evaluating responses, and catching edge cases that traditional software testing misses. The platform has gained traction in the developer community: over 2,400 GitHub stars and 300,000+ monthly installs.

Hey Savi - Fashion search engine for visual discovery

You see someone wearing a coat you love. No idea where to find it. Hey Savi built a fashion search engine that works from screenshots or descriptions, scanning across retailers to find items in stock, in your size, and at the best price. Think Shazam for fashion—snap a photo, and Hey Savi finds where to buy it. Angel investors, including Founders Capital and WITSEND Angels, backed the company's £2-3 million raise.

Droidrun - Mobile AI agents

AI agents work well on desktop and web. Mobile has remained largely inaccessible to automation. Droidrun converts mobile interfaces into structured text that AI models can understand natively, enabling precise, production-ready automation on mobile devices. Merantix Capital led the €2.1 million round, with participation from SixtyDegree Capital and prominent angels, including the co-founder of Silo AI (acquired by AMD). In just 10 weeks after launching their open-source framework, over 900 developers signed up.

Aurea - Gaming social network unifying player identity

Gamers play across consoles, PC, and mobile. Their achievements and activity remain fragmented. Aurea unifies this identity into a single profile—"Strava for gamers." The platform aggregates gaming activity from 3.3 billion players worldwide into a social network where achievements, playtime, and progression live in one place. The goal is to become the central identity layer for gaming.

Peaky - Financial forecasting with assumption drift detection

Scale-ups create financial forecasts based on assumptions about customer acquisition, churn, and growth rates. When these assumptions drift from reality, forecasts become unreliable. Most teams don't notice until quarterly results miss targets. Peaky monitors key assumptions in real-time using data from Stripe, HRIS systems, and ERPs. When conditions shift, Peaky recalculates forecasts and flags potential risks before they impact the business. The platform targets CFOs and accounting firms serving high-growth companies.

Hook - AI for predictable viral content

Most brands treat viral content as luck. Hook argues it's pattern recognition. Their AI analyses successful content across social platforms, identifying the specific elements—hooks, pacing, audio choices, visual patterns—that drive engagement. The system generates content ideas and scripts tailored to specific audiences and algorithms. Over 100 video agencies and direct-to-consumer brands use Hook to create content that performs consistently.

Fether Labs - Wristbands for controlling AR glasses and devices

Typing on a keyboard or tapping a screen doesn't translate well to augmented reality glasses. Fether Labs built wristbands that detect electrical signals when your brain tells your hand to move—electromyography translates gestures and finger movements into commands. Users control devices with subtle hand motions, starting with AR glasses. It's similar to technology Meta has explored, but Fether Labs is commercialising it for consumer and enterprise applications.

Fortell - Voice AI for vulnerable populations

Organisations working with refugees, displaced populations, or underserved communities often need to gather feedback and data from these groups. That typically requires expensive, dangerous field visits. Fortell uses multilingual voice AI avatars to conduct interviews remotely, collecting data from conflict zones and remote areas, then transcribing, translating, and analysing responses. Oxfam and the Norwegian Refugee Council use Fortell to evaluate aid programs more safely and efficiently.

Prescient Labs - Measuring real ROI of AI in professional services

Mid-sized consulting, accounting, and legal firms invest in AI tools but struggle to measure actual impact. Prescient Labs maps company workflows to identify where AI automation would deliver the highest returns—before firms commit budget. The system quantifies potential time savings, cost reductions, and productivity gains by analysing how teams currently work. Which processes should we automate first, and what will the payback be? That's what Prescient Labs answers.

Eat Ping - Cloud kitchen for Asian ready meals

Meal delivery services in the UK offer limited Asian cuisine options. When available, they often sacrifice authenticity for convenience. Eat Ping operates a cloud kitchen focused specifically on fresh, chef-made Chinese and Asian meals. The company prepares meals from scratch on Mondays and delivers them for the week ahead. Customers get nutritious, authentic dishes without the typical trade-offs of delivery food.

ManaMind - AI bots for video game QA testing

Video game developers spend months on quality assurance testing, manually playing through builds to find bugs. ManaMind automates this with AI bots that play games like human testers, replicating realistic behaviour and encountering the same bugs along the way. The bots operate 24/7 and work with any platform, device, or game engine. ManaMind claims developers can reduce QA budgets by up to 80% and cut development time by up to eight months.

Gaggl - Creator-hosted TV

Streamers regularly host watch parties where they view TV shows with their audience. Copyright restrictions make this legally risky at scale. Gaggl partners directly with studios to provide licensed content that creators can stream legally while adding commentary. Traditional watch parties become a legitimate distribution channel where creators get paid to host content, studios reach new audiences, and viewers get an interactive experience. Gaggl works across Twitch, YouTube, TikTok, Instagram, and other platforms.

PilotGo - AI agent for car repair workshops

Auto repair shops lose significant time on non-revenue tasks: answering phone calls, creating quotes, managing customer communications,and documenting repairs. PilotGo provides AI agents that handle these workflows automatically—answering calls, scheduling appointments, generating quotes by identifying parts from vehicle identification numbers, and sending customer updates. For workshops, it means more billable hours on actual repairs rather than administrative work.

ivee - Global infrastructure for career transitions

Millions of women take career breaks and face significant barriers when returning to work, including outdated skills, confidence gaps, and difficulty finding flexible roles. Ivee connects women returning to work with companies seeking qualified talent, combining job listings from vetted employers with skills training, community support, and a return-to-work bootcamp. The focus is on making career transitions accessible to a qualified but often overlooked talent pool. The company recently appeared on Dragons' Den and is backed by investors, including Balderton Launched '25 and Techstars '24.

Audio Games - Social gaming using only voice

Most social gaming requires screens, controllers, and visual attention. Audio Games removes all of that, creating games that work entirely through voice. Players interact solely through speaking and listening, making gaming accessible while driving, exercising, or engaging in other activities. Gaming in contexts where traditional gaming isn't possible—that's what Audio Games opens up.

BLNG - Creative suite for the jewellery industry

Jewellery designers typically move from sketch to physical prototype through a slow, expensive process involving CAD modelling and rendering. BLNG compresses this timeline with AI tools that transform sketches, photos, or text descriptions into photorealistic jewellery renders in seconds. Designers can iterate quickly, gather feedback, and approve designs without producing physical prototypes. The platform works on web and mobile, keeping design teams aligned and reducing revision cycles.

Clanmark - Gated marketplace accessible by sponsorship only

Most marketplaces operate on an open-access model: anyone can buy or sell. Clanmark takes the opposite approach—access requires sponsorship from existing members. The model creates exclusivity and trust through social accountability. Members vouch for new participants. Details about the specific products or services traded on Clanmark remain limited, but the sponsorship model suggests a focus on quality and reputation over volume.

Where they're from, what they do, and where they're headed

The 21 finalists share several characteristics that reveal broader patterns in European early-stage funding.

Geography and market focus

Most companies are UK-based, but their ambitions are global. Smart Bricks operates in international real estate markets. Droidrun serves developers worldwide. Fortell works in conflict zones across multiple continents. Many began in London or other UK cities, but they're building products designed for global markets from day one.

Sector concentration

AI dominated the cohort—not as hype, but as infrastructure. Fourteen of the 21 companies use AI as core technology, but in applied contexts: scam prevention (Falkin), legal operations (Narrative AI), game testing (ManaMind), workflow analysis (Prescient Labs). These aren't AI companies. They're companies solving specific problems that happen to require AI.

Four companies target the gaming and entertainment market: ManaMind, Aurea, Audio Games, and Gaggl. Three serve professional services or enterprise clients: Narrative AI, Prescient Labs, and Peaky. The cohort reflects where venture capital currently sees opportunity: narrow applications of AI, gaming infrastructure, and tools that help companies operate more efficiently.

Stage and maturity

Funding levels range from pre-seed to companies that have raised £2-3 million. Most are in the £500,000 to £2 million range—early but not brand new. Several have meaningful traction: LangWatch has 2,400 GitHub stars and 300,000 monthly installs. Droidrun signed up 900 developers in 10 weeks. Hey Savi has raised between £2-3 million. These companies have moved past the pure idea stage into building products that users actually use.

Business model patterns

Software-as-a-service dominates: Peaky, LangWatch, Prescient Labs, and PilotGo all follow recurring revenue models. Platform plays are also common: Aurea, Gaggl, ivee, and Clanmark build networks where value increases with more participants. A few, like Eat Ping and BLNG, serve traditional markets (food delivery, jewellery) with technology that changes the production process rather than the end product.

What they're raising for

All 21 companies are actively fundraising. For the earlier-stage companies, capital will fund product development and early customer acquisition. For those with traction, the next round of funding is for scaling: expanding sales teams, entering new markets, or adding features that current customers request. The mix of maturity levels means investors at this demo day could write seed checks or lead Series A rounds.

Common threads

Strip away the sectors and technologies, and most of these companies share a core insight: existing workflows waste time and money. Narrative AI eliminates non-billable hours at law firms. PilotGo reduces administrative burden at repair shops. Prescient Labs identifies where automation delivers real returns. ManaMind replaces months of manual testing. The product might be AI, a marketplace, or a wristband—but the value proposition remains consistent: do more with less friction.

The cohort also reveals what's missing. Few companies tackle climate, energy, or hard sciences. None are building physical products beyond Fether Labs' wristbands. The focus skews heavily toward software, services, and digital platforms. This reflects where venture capital flows most easily, but also suggests entire categories received little attention in this particular batch.

For investors, the cohort offers entry points across sectors, stages, and risk profiles. For founders building companies, it provides a snapshot of what's currently considered fundable in Europe: applied AI, gaming infrastructure, enterprise efficiency tools, and consumer platforms with clear unit economics. Whether that's the right mix depends on what happens when these companies report back in 12 months.